Many injured people in Phoenix worry about taxes after receiving a settlement. We hear this question from almost every new client. People want to know if the IRS will take part of their compensation. People also want to understand how Arizona handles these payments.

The truth is simple. Most personal injury settlements are not taxable. Some parts may be subject to taxation in certain situations. We want our clients to know exactly what to expect so they feel safe and protected through the entire process.

Why Most Personal Injury Settlements Are Not Taxable

The IRS treats personal injury compensation as a form of money that replaces a loss. This money covers medical bills, physical injuries, emotional harm, and lost earning ability. These losses result from an accident, not from income. Because of this, settlement money for physical injuries is usually not taxed.

A Phoenix personal injury lawyer explains this rule to every client because it helps people feel at ease. It also helps them plan for medical care, financial recovery, and long-term needs.

When Settlement Money May Be Taxed

Some parts of a settlement can be taxed. These usually include:

- Interest added to the settlement

- Punitive damages

- Compensation for lost wages

- Compensation for emotional distress that did not come from a physical injury

Interest is taxable because it is treated as income. Punitive damages are taxable because they punish the defendant rather than replace a loss. Lost wage compensation is taxable because it replaces taxable income. These rules apply to most cases in Phoenix, Arizona.

A personal injury attorney in Phoenix, AZ, reviews each category with clients. We want to protect people from unexpected tax obligations.

How Medical Expenses Affect Taxes

Many clients ask about medical expenses because they save receipts. If a client deducted medical bills on a past tax return, the IRS may tax the part of the settlement that reimburses those specific expenses. The IRS does this to prevent a double benefit.

We encourage clients to gather all records. We help them understand which medical expenses are related to the accident. This enables us to structure the settlement in a manner that provides clear tax implications.

How Arizona Law Impacts The Tax Question

Arizona follows federal tax guidelines for personal injury settlements. This means the IRS rules matter most. Local factors matter because Phoenix has high medical costs, a high volume of traffic, and a large number of insurance disputes. These conditions often increase settlement amounts. Our team explains how each part of the settlement fits IRS definitions.

A Phoenix, Arizona injury lawyer with experience in local courts understands how to document injuries. Precise documentation helps demonstrate to the IRS that the settlement is related to physical harm. This protects non-taxable status.

How Settlement Structure Can Reduce Tax Risk

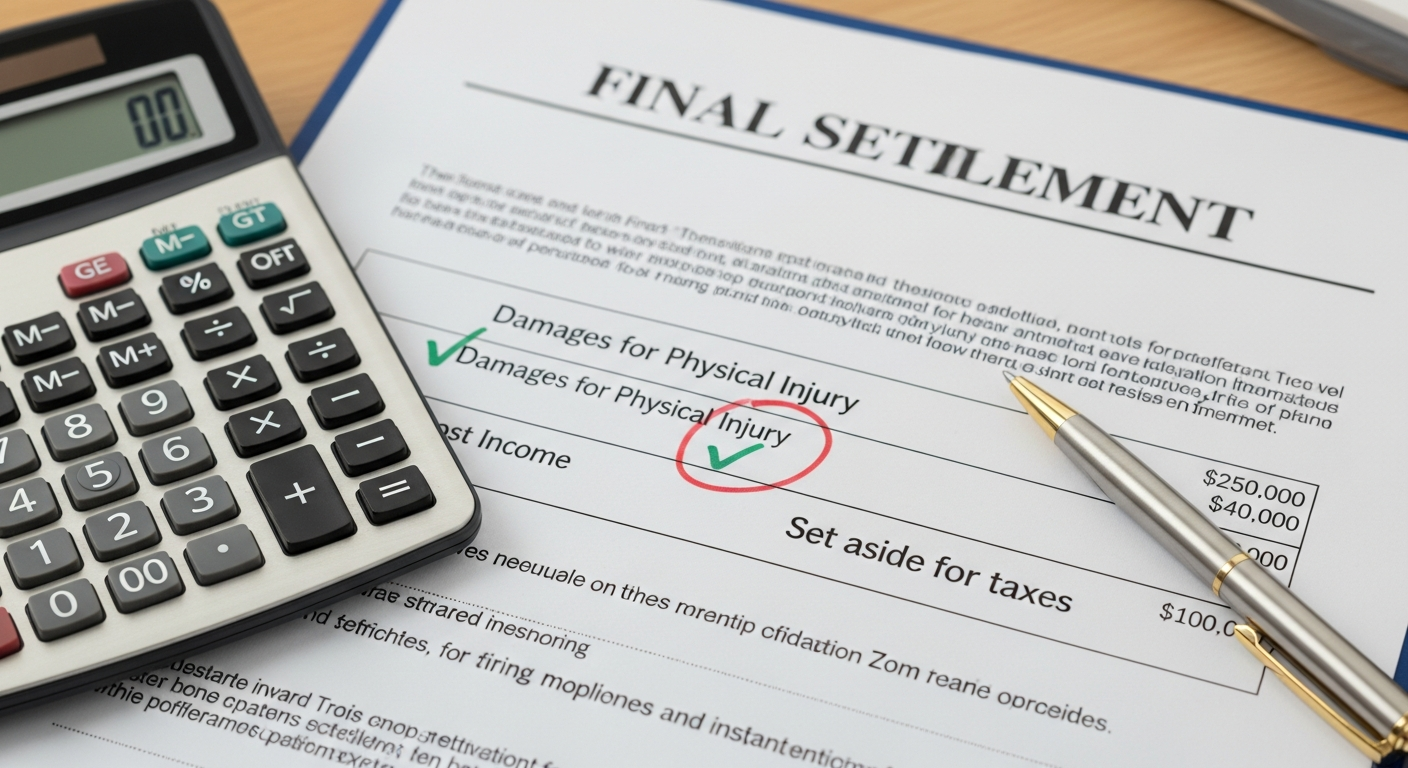

We review settlement breakdowns with each client before finalizing any agreement. We focus on:

- Clear definitions for medical damages

- Clear definitions for pain and suffering

- Correct classification of lost wages

- Accurate separation of taxable and non-taxable portions

This careful structure reduces confusion when the client files taxes. Good documentation also helps if the IRS asks for proof.

Why Legal Guidance Matters Before You Sign Anything

Many people settle too early. They sign paperwork without understanding the tax implications. They also speak directly with insurance companies, who may misclassify damages. Incorrect labels can increase taxable portions.

We step in early. We direct communication. We protect the settlement’s structure. We explain tax outcomes in simple and predictable terms, allowing clients to plan for the future.

What Clients Can Do Right Now

Clients can protect themselves by taking the following steps:

- Save medical invoices

- Save proof of income changes

- Keep treatment records

- Avoid speaking with insurance adjusters about tax issues

- Contact a lawyer before signing any release or settlement paperwork

These steps strengthen both the settlement and the tax position.

Our Team Helps Protect Your Rights

Most people do not pay taxes on the part of a settlement that covers physical injuries. Some parts may be taxable depending on the category. Our job at GLG Personal Injury Lawyers is to protect clients through every stage. We explain IRS rules. We structure settlements clearly. We reduce risk and protect compensation.

Anyone who has questions can contact our team. Another lawyer may give general guidance. We provide direct answers based on Arizona law and the details of the case.